The Buzz on Pvm Accounting

The Buzz on Pvm Accounting

Blog Article

Rumored Buzz on Pvm Accounting

Table of ContentsHow Pvm Accounting can Save You Time, Stress, and Money.4 Easy Facts About Pvm Accounting ExplainedThe Only Guide for Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Talking AboutThe 7-Second Trick For Pvm AccountingAll about Pvm AccountingGetting The Pvm Accounting To WorkThe 6-Minute Rule for Pvm Accounting

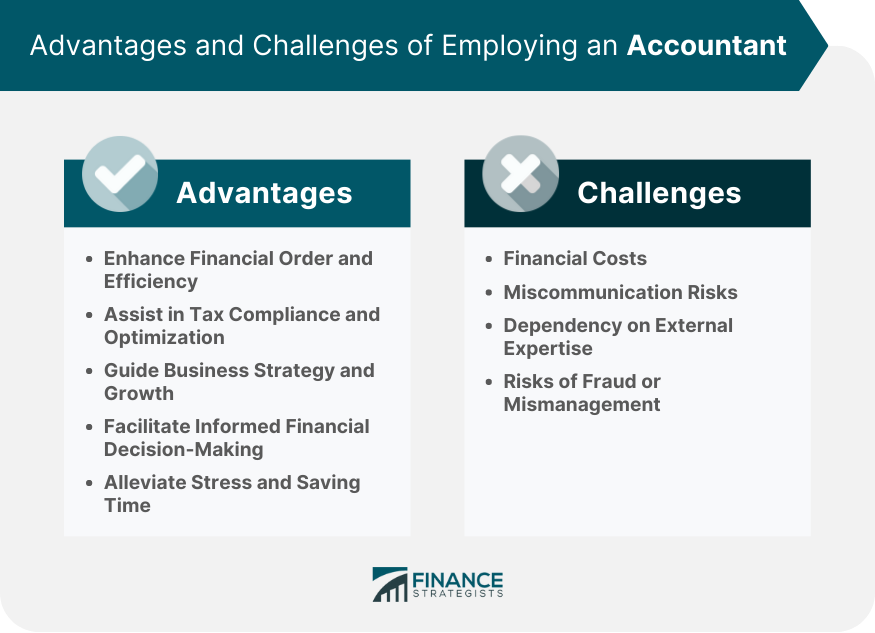

Running your service everyday can easily consume every one of your efficient time as a local business owner. It can be frustrating to keep complete oversight of your finances, particularly if your business is larger than a one-person operation. An excellent accounting professional will help you manage your venture's monetary statements, keep your publications clean, and guarantee you have the constant positive money flow or get on the roadway to achieving it.Yet we purely guidance to individuals seek advice from a certified and specialist financial expert for any type of sort of investment you require. We just write about the financial investment and personal money suggestions for details and instructional function right here. They can also aid educate you subjects such as exactly how to find your financing fee on financings to name a few topics

They have an eye for income streams and can keep the economic structure in mint condition. They do not have the exact same prejudice as close friends or family, and they are not intertwined with your business the means workers are. The distinction between finance and bookkeeping is that audit concentrates on the everyday flow of money in and out of a company or establishment, whereas finance is a wider term for the administration of properties and obligations and the planning of future development.

Some Ideas on Pvm Accounting You Need To Know

You could not need to use an accountant for all of your financial requirements. You can employ an accountant throughout the start-up stage and have them handle your annual coverage, but deal with a bookkeeper to manage your books often. An accountant can additionally help business to monitor its monetary efficiency and identify locations where it can improve.

The demands and procedures for becoming a Chartered Accountant differ relying on the certain professional body. It isn't called the gold handcuffs without good factor, and it's normally located in city/stockbrokers who get a high earnings extremely promptly. They acquire the new residence, high-end auto and participate in luxury vacations.

Excitement About Pvm Accounting

As you can see, accountants can assist you out throughout every phase of your business's growth. That does not imply you have to work with one, but the best accounting professional needs to make life easier for you, so you can focus on what you enjoy doing. A certified public accountant can help in taxes while likewise providing clients with non-tax services such as auditing and monetary encouraging.

An additional significant drawback to accounting professionals is their disposition for error. Although hiring an accountant reduces the likelihood of filing incorrect documentation, it does not totally get rid of the opportunity of human mistake impacting the income tax return. A personal accounting professional can aid you intend your retirement and likewise withdrawl. They can aid you handle your series of returns run the risk of to make certain that you don't run out of cash.

Not known Factual Statements About Pvm Accounting

This will aid you create an organization plan that's sensible, expert and a lot more most likely to be successful. An accounting professional is a professional that oversees the monetary health of your business, all the time. Every small company proprietor need to consider employing an accountant before they really need one. In addition, individual accounting professionals permit their customers to preserve time.

An accountant is qualified to guarantee that your business adhere to all tax obligation regulations and company law, including challenging ones that entrepreneur frequently neglect. Whichever accounting professional you select, see to it they can offer you a feeling of what their background and abilities are, and ask them exactly how they visualize building a healthy financial future for your business.

The smart Trick of Pvm Accounting That Nobody is Discussing

Your accountant will certainly likewise offer you a sense of essential startup expenses and investments and can reveal you just how to keep functioning also in periods of reduced or unfavorable cash flow.

A Biased View of Pvm Accounting

Running a small company can be an uphill struggle, and there are several facets to track. Filing tax obligations and taking care of finances can be particularly testing for little service proprietors, as it requires knowledge of tax obligation codes and economic laws. This is where a CPA is available in. A State-licensed Accountant (CERTIFIED PUBLIC ACCOUNTANT) can supply invaluable assistance to small company owners and aid them navigate the complicated globe of finance.

: When it concerns accounting, bookkeeping, and financial preparation, a certified public accountant has the knowledge and experience to aid you make educated decisions. This proficiency can save tiny business proprietors both money and time, as they can depend on the CPA's expertise to ensure they are making the very best economic selections for their business.

Certified public accountants are trained to stay up-to-date with tax obligation legislations and can prepare accurate and prompt income tax return. financial reports. This can conserve local business proprietors from frustrations down the line and guarantee they do not encounter any type of fines or fines.: A certified public accountant can likewise assist local business proprietors with monetary planning, which entails budgeting and projecting for future development

A Biased View of Pvm Accounting

: A CPA can likewise provide important insight and evaluation for local business proprietors. They can help identify locations where the business is thriving and areas that need enhancement. Armed with this details, tiny organization owners can make modifications to their operations to maximize their profits.: Lastly, hiring a CPA can supply small company proprietors with satisfaction.

Additionally, CPAs can provide assistance and support during monetary situations, such as when business encounters unanticipated costs or a sudden decrease in earnings. Employing a CPA for your tiny company can offer various advantages. From experience in tax obligation declaring and financial preparation, to analysis and comfort, Riedel-Hogan CPA can assist small organization proprietors navigate the intricate globe of finance.

The federal government will not have the funds to provide the solutions we all rely upon without our taxes. For this reason, everyone is encouraged to organize their tax obligations before the due day to guarantee they stay clear of fines.

The Only Guide for Pvm Accounting

The dimension of your income tax return depends on many variables, including your income, reductions, and credit go to my site histories. For this factor, working with an accounting professional is suggested due to the fact that they can see every little thing to guarantee you obtain the maximum quantity of money. Despite this, many individuals reject to do so since they believe it's absolutely nothing more than an unneeded cost.

When you employ an accounting professional, they can assist you prevent these errors and guarantee you obtain one of the most cash back from your tax return. They have the understanding and experience to recognize what you're qualified for and just how to get one of the most cash back. Tax period is usually a difficult time for any taxpayer, and for an excellent reason.

Report this page